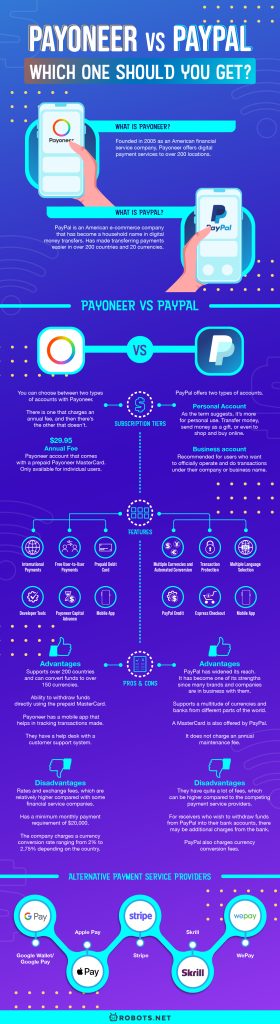

Payoneer and Paypal are arguably the two most popular digital payment services in their industry. They are most likely compared with each other if you’re talking about the best platform for making online payments and transactions. To know which suits your business needs best, here is a comparative analysis of the two.

What Is Payoneer?

Founded in 2005 as an American financial service company, Payoneer offers digital payment services to over 200 locations. Today, businesses and professionals globally can connect through Payoneer’s cross-border payments platform. Some businesses and freelancers have considered this their preferred online payment service provider. This company caters to clients receiving accounts. These accounts receive local transfers from global marketplaces directly to their Payoneer account. This means that if you have a customer that pays using a local bank transfer, Payoneer will transfer that fund to your Payoneer account. With this global service payment, you would also enjoy the perks of not paying any cent when paying another Payoneer user anywhere in the world. Payoneer also has easy integration to any website. It makes it one of the preferred financial service companies by most businesses.

Payoneer Subscription Tiers

You can choose between two types of accounts with Payoneer. There is one that charges an annual fee, and then there’s the other that doesn’t. If you’re going to choose the one that does not need an annual fee, you should know that withdrawing money will be done using your local bank account. On the other hand, there’s a Payoneer account that comes with a prepaid Payoneer MasterCard. This charges an annual fee of $29.95 and is only available for individual users, not businesses. To receive payments using prepaid MasterCard, you’ll be needing to activate it first. The good thing about this type of account is you wouldn’t be needing any bank account to withdraw funds. You can use it as your regular credit card and also use it to purchase items online. There is another method that you can do to withdraw funds without MasterCard. In this case, however, you’ll be needing a local bank account. All you need to do is link it with your Payoneer account. As soon as you receive the funds in your Payoneer account, you can transfer them to your bank account. With that, you can withdraw local currency at a low price.

Payoneer’s Unique Features

There are a lot of things to consider when choosing a payment service provider. Here are some of Payoneer’s most notable features, which can help you determine if the service would fit your needs.

International Payments

Payoneer can process payments globally using the third-party processor Global Payments. With this, you can receive funds locally transferred from marketplaces in different parts of the globe. The transferred funds will go directly to your Payoneer account. The customers must first receive a request for them to be able to pay. Once they pay, the money will be deposited into your Payoneer account. You can then transfer the received payment to your local bank account, which you can also convert to your local currency. Payoneer has a wide range of money conversion since it can convert payments into over 150 currencies.

Free User-to-User Payments

While it can send and receive payments from the customers, it also has a unique function called “Make a Payment.” With this, the Payoneer account holder can transfer payments to another Payoneer account paying no extra fee.

Prepaid Debit Card

Payoneer also offers the account holders to avail of the MasterCard debit card. This can be used to make payments using the funds from their Payoneer account. You can use the card like a regular debit card, as it can work at teller machines. This, however, charges $29.95 for an annual fee.

Developer Tools

Payoneer makes it easier to arrange recurring payments by providing its users with an API. This API is used to allow them to debit automatically the balance of an existing Payoneer user. But note that this can only be possible if that specific user consents to have their account debited automatically. If the account is found to not have enough funds available, Payoneer will not debit the user’s account. This is done to avoid the possibility of a chargeback.

Payoneer Capital Advance

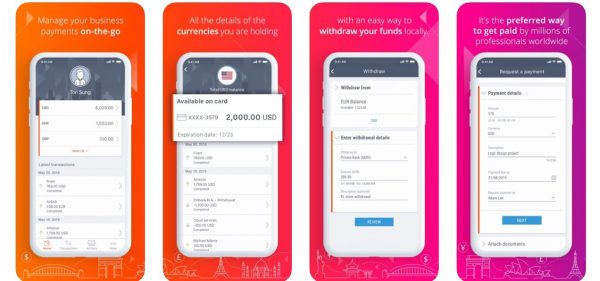

Mobile App

Inquiring about your account balance and viewing transactions can sometimes be challenging. With the help of a mobile app, everything will be easier. Payoneer has a mobile app available for iOS and Android users, so it is more convenient to know the history of your transactions.

Security

Security is probably the paramount consideration in choosing a payment service provider. No one would want to have a business with a company with questionable security. It’s a good thing that Payoneer guarantees its users to have secure transactions. On top of that, Payoneer is PCI-compliant and is also offering fraud detection to all customers.

Pros & Cons of Payoneer

There are a lot of advantages to using Payoneer, but there are also downsides that may affect your decision on Payoneer vs PayPal.

Advantages

One of the best things about Payoneer is its global reach as it supports over 200 countries and can convert funds to over 150 currencies. It can also give the users the ability to withdraw funds directly using the prepaid MasterCard that can be availed by the users. Sending and receiving funds is also easier, be it a domestic or international transaction. This makes it more convenient if you need to get the funds sooner. Despite having a high rate of $3 per transfer, it can still be a good thing since receiving doesn’t cost any fee. It was also mentioned that Payoneer has a mobile app that helps in tracking transactions made with the Payoneer account. If you encounter a problem or have anything to inquire about, they have a help desk with a customer support system. They also have offices in multiple countries which you can reach via email, phone, or live chat.

Disadvantages

Payoneer also has some potential drawbacks. One of those is the rates and exchange fees, which are relatively higher compared with some financial service companies. Another thing is it has a minimum monthly payment requirement of $20,000, which may be a little odd for others. Additionally, it takes a Payoneer account to transfer funds to another Payoneer account. The company charges a currency conversion rate ranging from 2% to 2.75% depending on the country where the transaction is made. Also, if you’re going to use your MasterCard for a non-listed currency, an exchange rate will apply. The annual fee of that card is also a potential turn-off for using a Payoneer account.

What Is PayPal?

PayPal is an American e-commerce company that has become a household name in digital money transfers. PayPal has made transferring payments easier in over 200 countries and 20 currencies. It is a bridge that allows users to link their accounts to the existing bank accounts that they are subscribing to. This company also has proven to be one of the top choices in payment service providers because of its series of security advancements. Thanks to PayPal’s anti-hacking and anti-phishing measures, users can request a refund if they’ve been cheated while using the platform. The suspicious accounts may be deactivated once Paypal has detected suspicious transactions.

Subscription Tiers

PayPal offers two types of accounts — Personal and Business. You can avail of the Personal account if you need to make purchases or send money to anyone you know. You can use this account to transfer money to a friend, send money as a gift, or even to shop and buy online. As the term suggests, it’s more for personal use. On the other hand, the Business account is recommended for users who want to officially operate and do transactions under their company or business name. You can also receive payments from different kinds of cards without costing so much. With the Business account, you can also give access to up to 200 employees to your account. You can also unlock some features like PayPal Checkout to meet your business needs. If you ever have a customer service issue regarding your products, you can also make a different email address.

PayPal’s Unique Features

PayPal offers quite a lot of features that you should also check out. Here are some functions that make PayPal one of the great choices.

Multiple Currencies and Automated Conversion

One of the unique features of PayPal is its ability to support various kinds of currencies. You wouldn’t also have to worry about the bank’s unnecessary conversion fees if you’re going to withdraw using your local bank account. This is because of PayPal’s automated currency conversion process that is based on the current exchange rate.

Multiple Language Selection

Having multiple languages available for customers around the world, this feature makes PayPal easier to use. It makes it less hassle for non-English users. Also, translating their language to English manually can sometimes give inaccurate results.

Transaction Protection

PayPal has established that transactions done with them are safe and secure. Its transaction dispute mechanism not only guarantees the protection of the buyer but also the seller. If a transaction is found to be a fraud or a scam, PayPal will hold up the money for as long as 180 days. This is to ensure that money lodged in the user’s account can still be used to make up for any debt owed by the account holder.

PayPal Credit

The PayPal Credit, formerly Bill Me Later, is one of the best features of PayPal. Not only does it allow you to fast track some financial transactions that you made, but it also helps you with payment if you have no immediate cash. With Paypal Credit, the account holder could purchase items despite not having enough funds in their account. The money to be used in that specific transaction would then be debited via the PayPal account holder’s bank account or credit card.

Mobile App

The PayPal app makes it more convenient for users to track their transactions. With PayPal, you can check your account balance with ease. It allows you to check the balance of your account easily. You can also transfer funds to and from your linked accounts or cards. This mobile app is available for iPhone and Android devices, so whatever device you have, you can still have access.

Express Checkout

Another thing that makes PayPal worth considering is the PayPal Checkout tool. This tool is made for those who have so much interest in online shopping. It makes purchasing online easier by eliminating the need to input billing and shipping details. The customers wouldn’t need to spend a lot of time inputting information by enabling this tool on sites available. All they need to do is log in with their PayPal username and password, then select the payment method connected to their PayPal account. With those simple steps, they will save a lot of time.

Pros and Cons of PayPal

Despite being an established name in the industry, PayPal has both its advantages and disadvantages. Consider these points in order to make the right choice.

Advantages

From the features mentioned above, it would be easy to tell that PayPal has a lot of good things to offer. Being around for a long time, PayPal has widened its reach. It has become one of its strengths since many brands and companies are in business with them. PayPal also supports a multitude of currencies and banks from different parts of the world. PayPal can also integrate with many accounting and customer relationship management platforms. A MasterCard is also offered by PayPal, which you can use conveniently because of brand reach. It does not charge an annual maintenance fee, which makes it better than other payment service providers.

Disadvantages

There are also some drawbacks in availing services from PayPal. One is that they have quite a lot of fees, which can be higher compared to the competing payment service providers. For receivers who wish to withdraw funds from PayPal into their bank accounts, there may be additional charges from the bank. The number of additional charges can vary depending on the country where the transaction was made. Another issue related to PayPal fees is that it also charges currency conversion fees. Converting the currency of the money to be received would have additional charges aside from the transaction fees. PayPal sometimes also holds accounts giving no warning, which can be challenging for some business owners.

Payoneer vs PayPal

Choosing between Payoneer and PayPal may be a hard decision. Now that we know the merits of both, it’s time to pit Payoneer vs Paypal. To help you decide which best suits your needs, here’s a comparison of the most vital features that these two payment service providers offer.

Safety and Security

When it comes to online transactions, the top concern is whether the process is safe to do. You would want to ensure that all of your personal information is protected and your funds are secured. Fortunately, both Payoneer and PayPal are very safe to use that no third party can see your personal information and funds. Payoneer uses strong encryption, so all the transactions made are strongly protected. This encryption also ensures that each of the inputted data is unreadable with the help of firewall protection. Payoneer also offers full regulations across different countries. To give the account holders another layer of security, Payoneer’s two-factor authentication can be very helpful. If there is unusual activity detected within your account, they can notify you by sending an email. PayPal, on the other hand, also ensures that all transactions made with them are heavily secured by their next-level encryption. In the case of claims and chargebacks, PayPal users will be less worried because of their buyer and seller protection center. PayPal can also hold up money found to be acquired illegally for up to 180 days. This is to ensure that money lodged in the user’s account can still be used to make up for any debt owed by the account holder.

The Winner: PayPal

Both Payoneer and PayPal pay attention to the level of safety and security they offer for the users. They also both aim to prevent fraud and identity theft by monitoring each transaction made with them. These two companies may be great in terms of safety and security, but one comes out better than the other. PayPal’s ability to hold money for up to six months for transactions found to be a fraud or a scam makes it a better choice. With this, the lodged money can still be returned. PayPal can also be considered a safer bet because it is a publicly-traded company.

Fees and Exchange Rates

Another thing that the users highly consider is the fees and rates. Processing payments using these financial services companies come with a fee. Both platforms charge relatively small fees to accomplish tasks. However, there can still be differences in how much each company charges in every transaction. There are different fees that Payoneer charges. It includes a fee for transferring funds from your Payoneer account to your local bank account. There is also a fee if you’re going to use your MasterCard when purchasing in foreign countries. Also included is the exchange rate margin of up to 3% when you withdraw or transfer balances between different currencies. A currency conversion fee of up to 3.5% can also apply should you spend funds from your Payoneer account using Payoneer MasterCard. You may also note that this MasterCard also charges an annual fee. On the other hand, PayPal also charges fees, and it varies depending on the place you live and the services offered. If you’re sending money within the US, there wouldn’t be any fee if you use your PayPal Cash, Cash Plus, or linked bank account. But if you use your credit card, debit card, or PayPal Credit, there will be a fee of 2.9% of the transfer amount in addition to the fixed fee. If you’ll be sending money overseas, there will be an additional transaction fee. Regardless of the payment method, you use in sending money overseas, an additional 5% of the transfer amount will be charged. If a transaction involves currency conversion, PayPal adds a margin of up to 3% on existing market rates.

The Winner: Payoneer

Payoneer’s fees and exchange rates are lower than PayPal’s. Sending money overseas would cost much less using Payoneer. Also, it doesn’t charge for payments made between Payoneer accounts. On the other hand, PayPal’s merchant payment gateway solutions hurt the business owners for its high cost. In this aspect, it’s apparent that Payoneer is the better option.

Mass and Speed of Payments

Whether the company offers Mass Payments and whether payments arrive early or late can be some factors in picking the best company. After all, everybody wants to receive payments as soon as possible and not wait for several days. Through Payoneer’s Global Bank Transfer service, you wouldn’t worry about the speed of the process. It is very convenient for account holders because the entire process is automated. The users can also receive payments in local currency to their bank accounts. They only need to wait for less than 24 hours from the time the transaction is initiated. With PayPal, on the other hand, there is a need to initiate every withdrawal manually to get funds in your bank account. This makes the process slow and time-consuming. Aside from that, your funds don’t reflect on your bank account in an instant. It would usually take between two to five business days to transfer the money. You can only transfer money instantly if you’re willing to pay additional fees using a different type of transaction.

The Winner: Payoneer

Both financial service companies offer mass payouts. But, in terms of speed in processing and withdrawals, it is evident that Payoneer beats PayPal. What takes several days for PayPal to process only takes several hours for Payoneer.

Ease of Use

The usability of the payment service provider is also one of the aspects that customers look at. The users would also consider whether it’s easy to use or would require much time to begin transactions. In this aspect, comparing both financial service companies would help you decide. When it comes to signing up, Payoneer offers a fairly straightforward process. However, there would also be a need for a US tax form to be completed when signing up. Payoneer’s payment options are one of the things they do well. It allows its users to process payments using bank account transfers. Users can also process payments using debit cards, credit cards, and Payoneer balances. It also has a mobile app available for iOS and Android devices. PayPal also does well in its sign-up process because you can use either the PayPal app or website when signing up. PayPal also offers various payment options. The users can fund their accounts and transfer their money using options like bank transfer, debit card, credit card, or PayPal Credit. PayPal also has a mobile app that makes it more convenient for users to track their transactions. This is available for iOS and Android devices, so whatever device you have, you can easily have access.

The Winner: PayPal

While both offer various payment options and a mobile app, there is a difference between the sign-up process of the two. The need to accomplish the USA tax form makes it time-consuming when signing up for Payoneer. It is also confusing when you’re not a US resident, so it would’ve been better if Payoneer provided assistance for non-US residents to complete tax forms. In this case, PayPal wins.

Support and Coverage

The countries being supported by the payment service providers must also not be missed when picking the best platform to use. Depending on your transaction needs, this can also be one of the factors to consider. Payoneer can support transactions or transfers to over 200 countries and territories. It should also be noted that using Payoneer, funds can be converted into over 150 currencies. Payoneer also offers customer support globally, which is available via chat, email, or over the phone. Their website is also available to be accessed in multiple languages. PayPal also provides its services in over 200 countries and territories, which means they also have a wide reach. You can contact PayPal over the phone for questions and inquiries, or you can also use their online Help Center and Message Assistant. PayPal’s website can also be used in different languages like that of Payoneer’s.

The Winner: Draw

In this aspect, the two payment service providers seem to do just the same. They have a wide range of reach as they both provide services in over 200 countries. Both companies also offer customer support, and their websites are available to be used in different languages. This being said, it is safe to say that it’s a draw in terms of support and countries.

Alternative Payment Service Providers

There are also a lot of service payment providers out there that you could use in case you’re looking for Payoneer or PayPal alternatives. Here are some companies that offer the same service.

Google Wallet/Google Pay

In making contactless payments with your phone, it is great to use Google Pay as it offers a fast and simple way to pay online. You wouldn’t question the security and safety of using this payment service provider because of its name. This being said, you wouldn’t have to worry because all the information on your payment is protected with multiple layers of security. Instead of your actual card number, Google pay allows you to pay with your phone with the use of an encrypted number. You can also send and receive money instantly using Google Pay by only needing an email address or phone number. Purchasing items online or in-app is also easier and can be done with just a simple press of a button. Not only can you send, receive, and pay using Google Pay, but you can also earn rewards and cash backs while still being protected the same way the bank does. Note that some features may vary depending on the country and device availability. Go to site

Apple Pay

If you know how to use Apple Pay, you’ll know that it’s convenient to use and works with every Apple device you have. Making contactless transactions is more convenient with Apple Pay since you can make secure purchases in stores and apps. Purchasing items on the web through Safari is also possible, even without creating an Apple account or filling out lengthy forms. This can be done with the use of Apple Pay. What makes this unique is that you can also pay in just a touch using your Touch ID on MacBook Air and Pro. Since Apple is known for its sophistication; safety and security wouldn’t be much of a concern. Apple makes Apple Pay a safer way to pay by using a device-specific number and a unique transaction code. This way, it wouldn’t be possible to store your card number on your device or Apple servers. Apple Pay is very easy to use, and you can also transfer money using Messages or by simply asking Siri. All the remittances will go directly to your Apple Pay cash balance transferable to your bank account. Go to site

Stripe

Stripe is an online payment service that allows users to send and receive money over the internet. This has a lot of features that are loved by code-savvy users. One of those features is the customizable development tools that make Stripe unique. Though it is possible to make sales transactions, e-commerce is its major focus. For each transaction done online, it charges a fee of $0.30 in addition to the flat fee of 2.9%. When making international transactions, Stripe can also support multiple currencies and payment methods. Stripe offers a decent amount of customization. But the usability of Stripe’s API and tools would be limited if you’re not really a tech-savvy business owner. You might also experience having your account frozen or canceled by Stripe. They might withhold your funds with a brief notice when they find your account to be of high risk. Go to site

Skrill

Skrill is another payment service provider that offers a safe method to pay across various platforms. It allows users to fund their accounts by card, bank transfer, or local payment options. With Skrill, you can easily send money to an email or phone number that is linked to a bank account. Skrill’s reach is also wide as it provides support in over 200 countries. They also offer a prepaid card powered by MasterCard for easier and more convenient transactions. Skrill can also support international transactions. However, it charges high currency exchange fees for Skrill to Skrill international transfers. If you want better treatment, you can avail yourself of a Skrill VIP account. This allows you to have higher transaction limits, relatively lower fees, and customer care like no other. Go to site

WePay

This payment service provider based in the US offers payment solutions for platform businesses. With WePay, you can accept payments from various credit card companies and banks. To process payments, you may use its API for a customized checkout experience, or you may also try embedding pre-written code within your site. Being affiliated with Chase Merchant Services, WePay allows users to receive same-day deposits. This is only possible if they use a Chase bank account. One thing that WePay does well is that they charge 2.9% and an additional $0.30 for every transaction without having other unnecessary costs. Go to site

Final Verdict: Payoneer vs PayPal

Payoneer and PayPal both offer convenience when making online transactions whatever type of user you are. Both companies can also provide secure and safe transactions, which would make you a little less worried. There would be aspects wherein you’d find either Payoneer or PayPal better. When it comes to Payoneer vs PayPal, it could be noted that in terms of usability, safety, and security, PayPal is a better option. But in terms of costs and speed of payment process, Payoneer is superior. The answer to which of the two you should get doesn’t lie entirely on the different aspects that both companies do well. It also depends on what service you need and how you want to use it. The decision is for you to make so identify which would fit you best to make the payment service provider you chose worth it.