What Is QuickBooks?

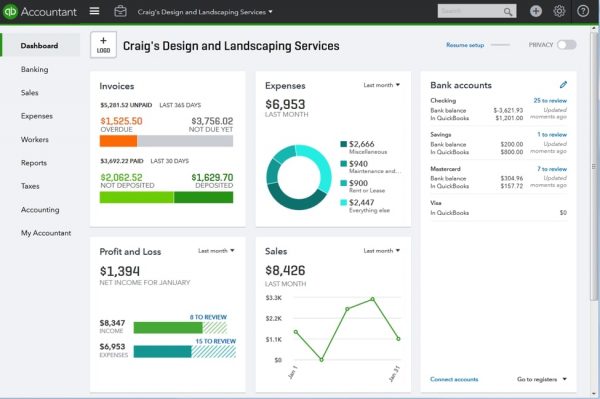

Owned by financial software company Intuit, QuickBooks is a simplified accounting solution for a variety of business types and sizes. The software is useful for managing invoices, accounts receivables, bills and expenses, inventory, and payroll, in addition to generating financial reports and tax documents. QuickBooks has approximately 290,000 companies under its care plus a 62.2% share in the market. QuickBooks offers six different service plans, which we’ll tackle more later. Each plan contains different features that cover basic business accounting tasks, and also non-accounting tasks. It’s also worth noting that QuickBooks has released a mobile version with the capability to scan receipts and track vehicle mileage.

What Can You Do with QuickBooks?

QuickBooks functions like a one-stop shop for all of your business accounting needs. Most business owners use it to manage their invoices, bills, and expenses. It’s also useful for managing business data and preparing for quarterly business taxes. It’s also easy enough to use for any normal business owner or a trained bookkeeper.

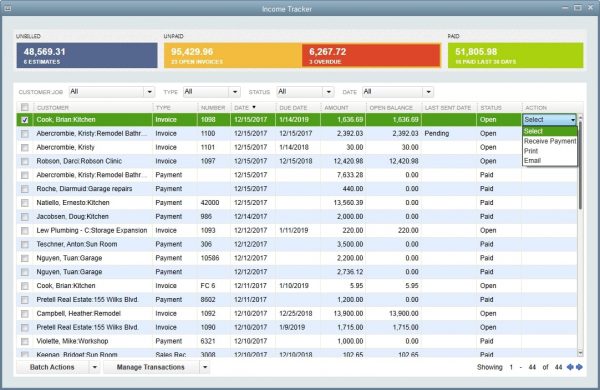

1. Create and Track Invoices

One of the key things that you can QuickBooks for is creating invoices. An invoice is essentially a bill containing details about the service or product delivered and the corresponding cost. The program offers a wide selection of chart of accounts templates (e.g., balance statements, loss and profit statements). You can also customize the templates to reflect your brand. QuickBooks will automatically track the status of your invoices to let you know who has paid and who hasn’t. The software is also able to produce an accounts receivable (A/R) aging report. This report is a detailed summary of all outstanding invoices and the number of days that they are past due. It’s also possible to have the software send automatic reminders to customers who are past due.

2. Keep Track of Bills and Expenses

Another thing that QuickBooks is good at is tracking the outward movement of your money in the way of bills and expenses. But this would require you to link your bank and credit accounts to the software. Once connected, it will automatically download and categorize your expenses and bills. If you want to keep track of check and cash transactions, that much is possible too. However, you would need to manually input the details of the cash/check transaction and then check back later for the status. QuickBooks can also help you keep track of your upcoming bills and payments. You just need to enter some of your bills into QuickBooks, and it will estimate the next payment deadline. You can also create an accounts payable (A/P) report for your own upcoming payments. The report will show you an itemized list of your current and past due bills.

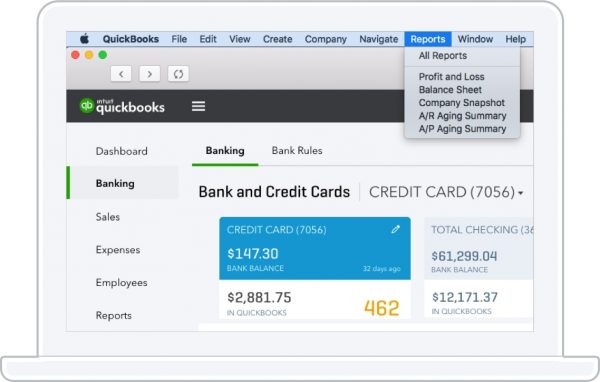

3. Generate Financial Statements

Every business needs reporting on its own performance and financial health. This reporting takes on a lot of forms, but is usually summarized in a “chart of accounts.” These charts of accounts focus on the key indicators of a company’s financial performance. Key indicators include income, cash flow, assets and liabilities, and so on. Most companies are required to submit these reports to their investors as part of a regular reporting process. In addition, these documents are also essential to preparing tax documents annually. QuickBooks offers a wide selection of standard reports built into the template. The more popular templates tackle the fundamental financial indicators that we have explained. Once you’ve selected a basic template, you can customize the template further. Let’s say that you selected an income statement as your template. You can choose whether the statement will be on a cash or accrual basis. You can also determine the period covered by the report and customize the colors that appear on it. There’s also a section that will allow you to add comments to the report, and you can then send the report over to someone else via email. Once you’ve finalized a report, you can share it with others via email or print it out straight from QuickBooks. The completed report will also become part of the searchable database. You can search for reports on a monthly, quarterly, semi-annual, or annual basis and any combination in between (i.e., this fiscal year, past month).

4. Track Employee Hours and Payroll

QuickBooks Payroll is a special offering that will allow you to manage your payroll. This feature isn’t free, though, which means that you will be charged extra each month for it. There are three options available to users: core, premium, and elite. All options come with full payroll service and automated payroll. They also include healthcare benefits, expert product support, and next-day direct deposits. When you sign up for Payroll, the system will ask you a series of questions regarding your business model and your payment process. You will reach a section where you need to add each and every one of your employees. From here, you can customize the salary and benefits of each employee, as well as the payment method (i.e., check or direct deposit). The system will also help you calculate total overtime fees for each employee. The software is also equipped with an automated payroll feature, which will allow you to send payment on a pre-set schedule. QuickBooks Payroll is also capable of conducting calculations for federal and state taxes. If you didn’t know, employers in the US are required to withhold federal income taxes from employees. They are required to fill out the Employee’s Withholding Allowance Certificate (W0-4) along with other tax forms (Form 1040, 1120, the 1120S, etc.). Payroll automatically fills out these tax forms, so you won’t have to fill them out manually.

5. Keep Track of Inventory

Accurate accounting for the COGS is important since it is part of the calculation of your taxable income. However, some business owners struggle with accounting for COGS manually over time. This is where QuickBooks comes in, helping you monitor the total value and movement of your inventory. It will automatically mark items under the category cost of goods sold (COGS) whenever you sell inventory. You can also allow QuickBooks to send you a notification whenever an item in your inventory is running low. If you need additional inventory, you can create a purchase order within the app and then send it to your supplier. Once you receive the physical items, you will need to log the transaction as an expense. Of course, you would also have to indicate how you paid for it, either through cash, check, or other means. QuickBooks is also capable of generating reports about your inventory. The most commonly used report is the Valuation Summary Report. It is essentially a detailed listing of all of the items on your inventory and their individual and collective values.

6. Simplify Taxes

One of the most important things that QuickBooks can do for you is to help you simplify your tax filing process. This would still require a lot of effort on your part since you would need to account for all receipts, invoices, and expenses. Keeping track of expenses is especially important since they often translate into tax deductions. If you keep track of everything ahead of time, all you have to do come tax time is to print the financial reports. Naturally, you would still have to fill in a variety of IRS forms, but it should be easier with all of your financial reports on hand. QuickBooks also offers integration with reliable tax software like TurboTax. It should help you fill out your forms straight from QuickBooks. If you want to see other options for tax solutions, you can check out this list of the best tax software for filing your taxes.

7. Accept Online Payments

A great way to ensure payment conversion is to provide a quicker way for customers to pay you. While online payment is not part of the standard QuickBooks package, there is a way to get an external app into your program. That is, you can integrate QuickBooks Payments (formerly known as Intuit Merchant Services) into your program. QuickBooks Payments function just like any other merchant service, and your customers can choose their preferred payment method. You can check out this list of the best mobile payment apps for some ideas on which platforms your customers prefer to pay with. But what makes Payment special is that it is completely integrated within QuickBooks. This means that the software will automatically log any payment that comes through into the appropriate ledgers.

8. Scan Receipts

Receipts play an important role in business accounting, but they get lost too easily. Luckily, QuickBooks has a mobile version that will let you take pictures of your receipts for accounting purposes. Just snap a picture of a receipt as soon as you get it and then upload it to the cloud. That way, you will have some proof of the transaction even if you lose the receipt. You can also match the receipt with a bank transaction on the spit so you would not have to match them up manually. This feature is particularly useful for retail and manufacturing companies with a lot of inventory.

9. Track Mileage

It’s common practice for business people, especially solo entrepreneurs to use their vehicles for business purposes. In the US, this practice can entitle you to tax deductions at a stipulated cost of USD 57.5 cents per mile (2020 value). However, the IRS requires that the business owner present a record of the trip’s date, mileage, and purpose. QuickBooks mobile can integrate with your phone’s GPS to track your mileage. You simply need to connect your QuickBooks mobile to your GPS. After that, you will have two options. You can either manually input your mileage into the app by reading your GPS data. You can also enable auto-tracking, and the app will automatically take note of when your starting and ending locations.

QuickBooks Service Plans

There are a total of six service plans under QuickBooks. Each service plan varies in terms of feature combinations, cost, and the number of user accounts. There are also layers within each plan for a fully customized experience. Let’s look at the core service plans below.

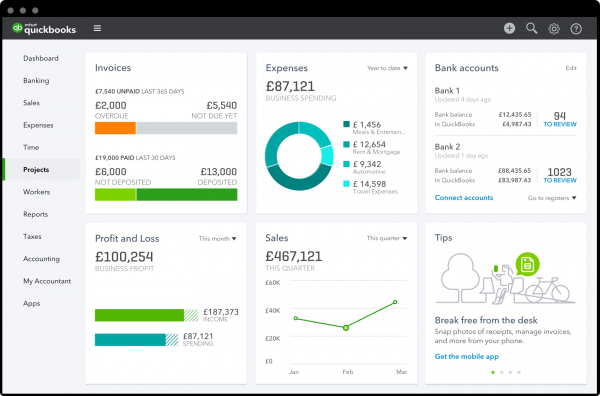

QuickBooks Online

QuickBooks Online is a cloud-based version of the software that is designed for small to medium-sized businesses. It’s also one of the most popular options on the list, with over 2.2 million users worldwide. The software covers all accounting bases with features for invoicing, expense tracking, and accounts payable. It also has contact management, project management, inventory, budgeting, class tracking, and more. The software accepts up to 25 user accounts. QuickBooks Online has four pricing tiers:

Simple Start: Track invoices, create estimates for prices, and track expenses, among many other things. Essentials: Adds accounts payable and time tracking to the features on top of the Simple Start benefits Plus: Everything in Essentials plus inventory, project management, class tracking, and budget management. Advanced: Offers greater flexibility with numerous perks, featuring faster and more comprehensive reports, premium apps for budget and workforce management, and added security measures.

QuickBooks Online also features a lending app called QuickBooks Capital. Capital is software that helps enter lending institutions for credit, should you need it. You can also integrate additional services such as QuickBooks Payroll, QuickBooks Payments, and Live Bookkeeping. You can also add tax e-filing and a custom invoice template, but all of these come at extra cost.

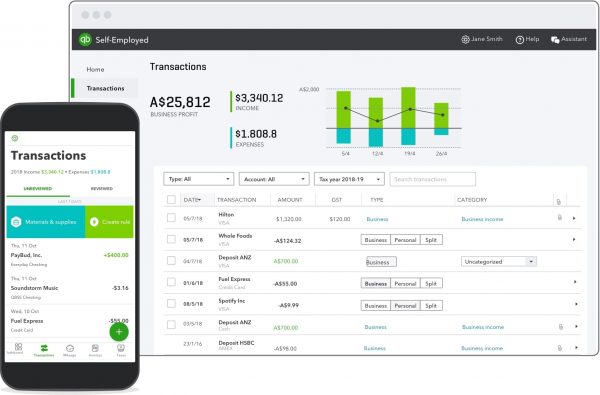

QuickBooks Self-Employed

QuickBooks Self-Employed is another version made for the self-employed. The software was specially designed to help self-employed individuals and freelancers accomplish their quarterly tax filings. In that sense, it’s really less of accounting software and more of tax software. The software is ideal for sole proprietors and freelancers, and as such, only allows you to create a single account. There are three tiers under QuickBooks Self-Employed:

Self-Employed: Includes tools that automatically track your income and expenses. These tools attach to your bank account to download your expense information and distinguish between personal and business expenses. There’s also a tax calculator that provides estimates of quarterly tax dues and deductions. This tier also features five reports: Mileage Log, Profit and Loss, Tax Summary, Tax Details, and Receipts. Tax Bundle: Everything under the basic package plus integration with TurboTax, which means you can pay your quarterly tax dues online. Live Tax Bundle: Also connected to TurboTax. In addition, you get real-time assistance from tax professionals. They will review the final draft of your IRS forms before you submit them. It’s also cloud-based, which means that you can access it exclusively via a web browser.

QuickBooks Self-Employed is also available as a mobile app. You can download it for any IOS or Android device.

QuickBooks Pro

QuickBooks Pro offers comprehensive accounting features, which makes it the ideal choice for accountants and accounting consultants. This edition is intended for individual or small business use since it can only accommodate up to three user accounts. QuickBooks Pro comes with a lot of features that are specific to accounting purposes. It offers a wide selection of charts of accounts, journal entries, bank reconciliation, and financial reports. Users also get over 130 charts of accounts templates to choose from. It also offers to track invoices and pending payments to vendors. It also features an improved company file size management system. This version also allows you to easily transfer files under storage into a new device. QuickBooks recently updated its software, and this latest version comes with additional features. You still get all the features from the original version, which we have enumerated above. But this new version will allow you to do things like sending automatic payment reminders when invoices are due. They have also improved the email functions of the software. You can now add purchase orders (POs) to the subject lines of your emails and consolidate multiple invoices into a single email. It also comes with improved bank feeds, new receipt management tools, and customizable payment receipts.

QuickBooks Premier

QuickBooks Premier is designed for small to medium-sized businesses and is industry-specific. This means that several variants are available to cater to the particular use case of different companies. There are five specific industries that QuickBooks Premier can cater to: One of the variants is the so-called standard or “generic” edition.. It comes with all basic accounting functions, but it doesn’t have industry-specific features. Some of the basic features included are income and expense tracking, contact management, invoices, bills payment, tax support, and so on. You also have the industry-specific editions, which contain industry-specific features on top of basic features.

General Business: All basic accounting functions including income and expense tracking, contact management, invoices, bills payment, tax support, and so on. General Contracting: Job costing center, change orders feature, custom billing rates, and contractor reports. Professional Services: Includes tools that will allow users to send invoices in a few clicks, track unbilled time and expenses. It can also analyze profitability and also set different billing rates for clients and vendors. Manufacturing and Wholesale: Includes sales order fulfillment, back-order tracking, item receipts, and so on. Non-Profit: Tools for receiving pledges and donations.

QuickBooks Premier is a desktop-based program, which means that you need to install it into your PC (Windows or Mac). The PC-based format means that you can use the software even in the absence of an internet connection. However, there will be functions within the software that will require an internet connection. QuickBooks also encourages Premier users to sign up for cloud hosting but this comes at an additional cost.

QuickBooks Enterprise

Enterprise is another variation of QuickBooks that is designed for middle to large-scale businesses. There are seven editions of Enterprise. One is a standard edition, while the rest are industry-specific variants. The industry-specific variants cover the same areas that Premier does. These include industries such as manufacturing and wholesale, nonprofit, contractor, retail, and accounting. At this point, you may be wondering how Enterprise differs from Premier. The answer relates to the size of the user base and the complexity of features. QuickBooks Premier was designed for small businesses and can only accommodate a maximum of five users. On the other hand, Enterprise was designed for a much larger audience and can be used by a maximum of 250 users. Enterprise is also a more complex solution compared to Premier. It has advanced tools for accounting, inventory management, contact management, and so on. This variant of QuickBooks has a few advantages to offer large-scale businesses. For starters, the software can support large files of up to 1 GB size. It will also allow you to do some job costing tasks such as time-tracking and creating job costing reports. You can also get add-ons for things like payroll tracking, supply chain management, and inventory tracking. A subscription to Enterprise also gets you one-year access to free tech support plus and an online vault. An online vault is a place where you can store your confidential reports.

QuickBooks for Mac

QuickBooks for Mac is designed for local installation and is exclusive to Mac users. The software is ideal for solo entrepreneurs and small businesses. It can accommodate up to three user accounts. QuickBooks Mac has all of the basic features found in QuickBooks Online. Some of its key features include invoicing, expense tracking, and contact management. There’s also an accounts payable feature that will alert you about unpaid bills, and you can print checks directly from the software. Additional features include time tracking, project management, budgeting, and inventory functions. You will also get approximately 100 chart-of-accounts templates. Unfortunately, QuickBooks for Mac lacks some add-ons that are available for free on other editions. It doesn’t readily integrate with QuickBooks Payroll and QuickBooks Payment. If you need those features, in particular, you would have to pay up extra for them. Unlike QuickBooks Online, this version does not offer live bank feeds. You would have to refresh the page connecting to your bank each time you need to view your recent transactions.

Final Thoughts on QuickBooks Business Accounting Software

QuickBooks belongs to the top ranks of the business accounting industry. But there are two things that separate it from the competition: its feature-rich plans and the capability for integration. QuickBooks packs each service plan with features that extend beyond basic accounting functions. The software also makes it easy to extend its value by integrating external software and add-ons into the program. It’s also very easy to get an upgrade without risking data loss. Finally, QuickBooks is always keen to innovate and keep up with the latest trends. Every few years, they release a new product or an improved plan with new features and better capabilities for integration. It also helps to advertise your business via some of the most reliable blogging platforms. Another way to advertise your business is to start your own YouTube channel.